Introduction

When it comes to the digitalization of Pakistan, payment gateways have a considerable influence.

Finding the finest payment gateways in Pakistan is the biggest problem for businesses looking to sell their goods or services online.

Here, we’ll delve deeply into the best (and most varied) solutions available on the market, across many industries, some of which you probably had never idea existed.

But let’s start with the basics first.

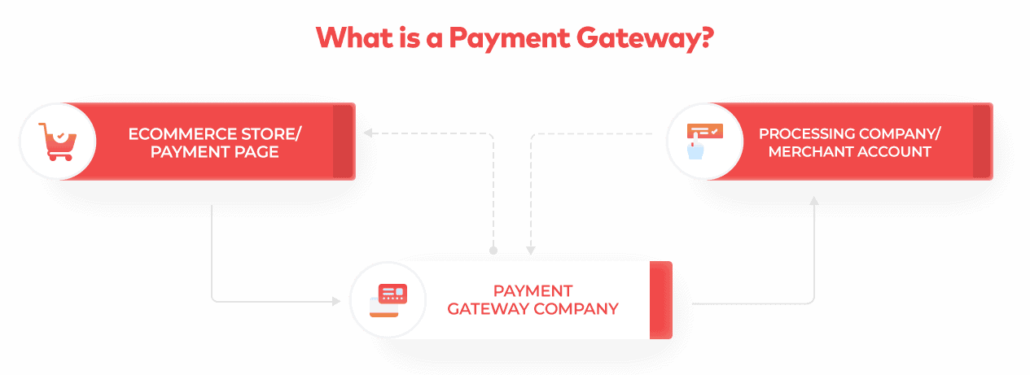

A payment gateway: what is it?

The tools that merchants use to take debit and credit card payments from customers are known as payment gateways.

In addition to the card readers frequently found in brick and mortar establishments, this also alludes to online systems that use the internet to deposit customer funds into sellers’ pockets.

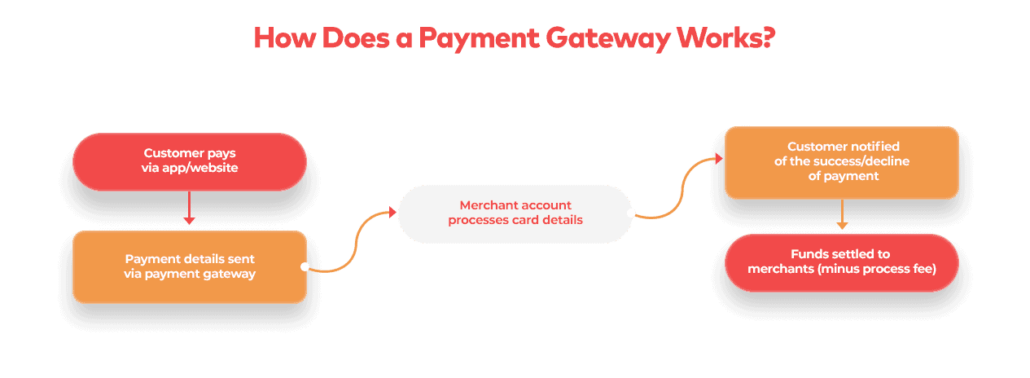

What is the process of a payment gateway?

Payment gateways, particularly online payment gateways, are front-end technology that send a customer’s financial information to the seller’s (merchant’s) bank, where the transaction is subsequently completed.

Here is a step-by-step explanation of how a payment gateway operates.

How a payment gateway operates

We now have a dense understanding of what a payment gateway is and how it connects the buyer and the seller’s financial models.

What Pakistan’s best payment gateways are now becomes a pertinent question. Let’s find out by classifying the payment gateways that are accessible in Pakistan into various groups.

Banks in Pakistan with the best payment gateways

The first thing that springs to mind when thinking of transactions, money, and selling/buying is banks.

Even when supported by modern technology, the transactional path always concludes at a bank account.

So let’s start with the banks in the nation that offer online payment gateways.

1- Habib Bank Limited

With a massive 27 million customers, Habib Bank Pakistan, often known as HBL Pakistan, is a top commercial bank in Pakistan.

Habib Bank continues to prioritise the expansion of the unbanked population while also aiming to improve online payment options.

Habib Bank provides straightforward and user-friendly transactional models for online payment gateways in Pakistan, regardless of whether you’re utilising a website, an eCommerce store, a mobile app, or social platforms like Facebook shop.

2- United Bank Limited

United Bank Limited (UBL), another significant competitor in the Pakistani banking sector, has a 4 million-strong customer base.

With over 1,400 branches nationally and 44,000 customer touchpoints, UBL is regarded as having one of the largest banking networks.

UBL established UBL Go Green Internet Merchant Acquiring Service, which intends to use the power of the internet to speed up transactions for both buyers and sellers across the country, taking into account the digital payment needs of a wide range of its clients.

3- Islamic Commercial Bank Limited

Due to its strong brand reputation that has been built up over the years, Muslim Commercial Bank Limited has a well-known name in the banking industry.

One of the few major companies in Pakistan’s finance sector, MCB has a sizable 7 million client base and a robust network of 1550 branches.

With the incorporation of the internet, MCB introduced its Internet banking programme, which attempts to give businesses the solutions they need to increase their online sales through the use of their user-friendly payment gateway.

4- Alfalh Bank Limited

Alfalh Bank Limited is another significant player in the banking sector in Pakistan.

In Pakistan, Bank Alfalh is regarded as the market leader for payment gateways.

Fin-Tech Companies in Pakistan with the Best Payment Gateways

We looked at some of the most noticeable names in banking who made online buying and selling simple.

Those are classic banks staying current, surviving, and avoiding being left behind in the sector.

Let’s now focus on a few contemporary fin-tech businesses (financial technology) that were created with the primary intention of simplifying transactions and financing.

1- Payoneer

A well-known payment platform called Payoneer was established in 2005 and offers digital payment services for companies, SMEs, corporations, and independent contractors.

Payoneer has significantly changed the financial industry, impacting everything from freelance markets like Fiverr and Upwork to eCommerce sites like Amazon and Shopee, and eventually, major corporations like Google and Airbnb.

Particularly in Pakistan, Payoneer is used on a par with PayPal in other nations.

Options for Transfer: Telephone and Online

Options for Withdrawal: Bank

Payment Options: Credit Card, Debit Card, and Bank Transfer

No, regular payments

2- JazzCash

A top mobile money transfer service in Pakistan is called JazzCash, and it is provided by the Jazz telecommunications group.

Simply said, a JazzCash account is a real bank account connected to your mobile number, enabling you to benefit from sending or receiving money at any time, anywhere.

JazzCash technically isn’t a fin-tech business, but they share the same objective of promoting freedom in financial services and transactions. The following information can be used to transfer or receive money:

- CNIC

- Account for mobile

- bank statement

- JazzCash can also be very helpful in the following services;

- repayment of loans

- Online transactions

- Insurance

- Savings programs

Over the years, JazzCash has had phenomenal development, and it now has over 9 million active users each month.

3- EasyPaisa

When EasyPaisa was originally introduced in Pakistan in 2009 by renowned telecommunications giant Telenor, it was the country’s first mobile banking service.

In 2020, EasyPaisa will have about 7.4 million active users and will continue to expand.

Generally speaking, EasyPaisa offers its subscribers the following financial services;

- payments for business and salary

- managing money

- Chain of custody payments

- gateway for online payments

EasyPaisa has experienced great growth in the fin-tech industry and has provided services to the following businesses:

- Uber

- Digital Ruba

- Seed Off

- Daraz

- Bykea

- HumMart

EasyPaisa provides the following benefits when it comes to online payment gateways;

- simple registration via a registration portal

- No need to worry with corporate accounts

- Easy access to internet integration support

4- FonePay

FonePay is a cutting-edge fin-tech business and mobile application that offers users simple banking services.

FonePay is a digitaly lifestyle platform powered by Mastercard that enables instant payments to anybody, anywhere, at any time.

Customers can pay for any tool or service they use from a third party using FonePAy. Here are a few of them:

- Gmail Play

- Hulu

- Netflix

- iTunes

- Amazon

They aim to make cashless transactions common and popular and are integrated with about 45 banks at the moment.

The service offers a variety of loyalty rewards. For staying with them for a long time, you receive discounts and superior economical packages.

5- SadaPay

Future digital wallet Sadapay offers international digital payment options. The State Bank of Pakistan has given them “in-principle” approval for the Electronic Money Institute (EMI) licence, allowing them to function as a digital wallet.

Through its mobile-first strategy, which makes it simpler for customers to sign up and conduct transactions, they hope to boost financial inclusion and threaten traditional banking. Additionally, you receive a Sadapay Mastercard, which is accepted in all 210 countries that are part of the Mastercard network.

Also read: Social Media Marketing for Your SAAS Business

6- Keenu Wallet

Another well-known digital wallet and online payment processor in Pakistan is Keenu Wallet.

The distance between physical establishments and online payment choices is closing thanks to Keenu Wallet.

There are several applications for Keenu Wallet. Here are some methods that it aids:

- Purchase anything using the app.

- Use specific bar codes when shopping.

- Make exchanges of money with one another.

Additionally, you can buy other services like bus reservations, insurance, etc.

After downloading the application, creating an account is also rather easy. The steps you must follow are listed below;

- Include your phone number and check the code.

- Include your name and CNIC in the sentence

- Check your ID; Keenu Wallet complies with SBP, thus you must do this.

Conclusion

It can be difficult to choose the finest payment gateway in Pakistan, especially with so many options accessible. Making the appropriate decision, however, is crucial because it will affect all of your company dealings.

Our ecommerce development services have provided us insight into the qualities that a perfect payment gateway should have as a digital business integrating online payment gateways for our clients.

We’ve identified a few things to take into account before choosing your online payment gateway in Pakistan, even though a particular choice will ultimately depend on the nature of your business, your targeted location and audience, the needs of the product/service market, and hundreds of other factors;

- An easy payment process

- Examine the costs and service contract.

- Examine the transaction’s efficiency.

- Make sure the checkout process is simple on all devices.

- Be sure the integration procedures are straightforward.

A free advice would be to avoid becoming paralyzed by the choices offered. In Pakistan, there isn’t a perfect payment gateway. Simply choose the one that is close to your company’s aims.

For more updates keep in touch with Connect Digital.